Payroll Write for us

Payroll write for us is the total compensation a business must pay its employees for a set period or on a given date. Usually, it manages by a business’s accounting or human resources department. Small-business payrolls may be handled right by the owner or an associate. Increasingly, Payroll is outsourced to specialized firms that handle paycheck processing, employee benefits and insurance, and accounting tasks such as tax withholding.

Payroll write for us is the total compensation a business must pay its employees for a set period or on a given date. Usually, it manages by a business’s accounting or human resources department. Small-business payrolls may be handled right by the owner or an associate. Increasingly, Payroll is outsourced to specialized firms that handle paycheck processing, employee benefits and insurance, and accounting tasks such as tax withholding.

When it comes to payroll meaning, you may hear phrases like:

- Running Payroll: This is the process of actually calculating and distributing wages and taxes.

- Employees on Payroll: This is the list of the employees you pay and their information. Keep in mind that it does not include independent contractors.

- Payroll expense: This is the amount your business spends on employee wages and taxes. It would help if you recorded the payment in your accounting books.

- It’s time to dive deeper into the parts of Payroll.

Payroll can also be referred to as the list of business employees and the compensation amount due to each. It is a significant expense for most businesses and is almost always deductible. This means the cost can be taken from gross income, depressing the company’s taxable income. It can change from one pay period to another because of overtime, sick pay, and other variables.

What is Payroll Processing?

Payroll processing is the procedure to pay employees at the end of a payroll period. This process contains multiple steps to ensure that pay adequately calculate, tracked, and doled out and that the correct amounts for tax: company benefits, and other deductions with hell. Payroll is often managed and administered by a dedicated payroll professional, but it could also fall under the purview of human resources.

How to Process Payroll

Establish your employer identification number. The first step in processing Payroll is establishing your EIN and state and local tax IDs. The government uses these identifications to track your business’s payroll taxes and ensure you’re meeting requirements.

If you don’t know your EIN or you don’t have one, you can visit the IRS website to set one up. You’ll have to go through your state and municipality for your state and local tax IDs. What are the best payroll system reviews for your small business? We can help!

Collect Relevant Employee Tax Information.

Before you start processing Payroll, your employees will have to fill out various tax forms so you can account for allowances and other tax details. These forms include the W-4. You must provide multiple state and local forms, depending on where your business operates.

Before processing an employee’s first paycheck from your company, you should also have these documents on hand:

Job application: Even if the employee never filled out a formal application, having this document on file ensures that all critical payroll information is in one place.

Deductions: Employees may participate in company benefits, such as health cover, a health savings account, or a departure savings plan. Proper payroll processing ensures the correct amounts for these benefits are met with hell each pay period.

Wage garnishments: You may be required by law to garnish your operatives’ wages if they owe money, such as IRS payments or child support. Wage garnishments are court-ordered; ensure you have the proper certification on hand and in your records.

Choose a payroll schedule.

Once you have the relevant tax and legal information to set up Payroll, you can choose the best schedule for your business. There are four main schedules: monthly, semi-monthly, biweekly, and weekly. Understanding each plan before deciding which is best for your business is essential. Once you choose a program, set up a calendar with paydays, and note when you’ll have to process Payroll for your workers to get their money on that day.

Build in important quarterly tax dates, holidays, and annual tax filing dates. Remember that you’ll have to do this at the start of every year. You’ll also want to establish the preferred delivery way for each employee. For example, many businesses allow employees to choose between paper checks and direct deposit.

What are the Disadvantages of using Payroll Write for us?

The manual payroll system requires payroll dispensation to be entirely done by hand. Therefore, time cards, wages, payroll tax computations; wage garnishments; and voluntary deductions make manually. Also, paychecks and pay stubs are handwritten or printed on a typewriter. The main disadvantage of this system is its high room for error. The more manual computations the payroll representative has to make, the more errors she’s prone to make. Furthermore, it’s time-consuming because to ensure accuracy, one has to triple-check the data before printing checks. Even then, it’s possible to miss errors.

Paper filing requires this system, which can create clutter. Moreover, if the payroll representative does not understand how to calculate payroll taxes manually, mistaken tax withholding, reporting, and payment occur. This may result in penalties from federal and state tax agencies.

Outsourced/External

The employer uses the outsourced or external payroll system when it hires a payroll service provider. The latter has a payroll staff that processes its clients’ Payroll for a flat fee. Services vary by provider, but most providers process paychecks and direct deposits. Many also offer payroll tax and benefits administration.

Since the employer trusts its payroll tasks to an off-site company, it can suffer from not having direct help when needed. If the payroll service provider has many clients, the company may have to wait in line to resolve any problems. Depending on the situation’s urgency, this can frustrate the employer. Also, according to the Internal Revenue Service, if the payroll service provider makes a tax error, the employer alone incurs the penalty. With the Payroll process off-site. If there’s a problem, the employer may not know about it until payday.

On-Site Computerized

The in-house electronic system enables the employer to use an on-site payroll staff and payroll software to process its Payroll. The company must invest in and maintain the software, which can be luxurious. Depending on the difficulty of the software, the proprietor may have to pay for training for the payroll staff. Additionally, depending on the size of the Payroll, the employer may have to employ an entire payroll staff.

This system can prove expensive in that it may require the company to pay salaries and benefits to the staff and also pay for technical support when software glitches occur. The employer has to also pay overtime (if worked) to payroll personnel who qualify for it.

How to Submit Your Articles?

To Write for Us, you can send correspondence at To Submitting Your Articles for my sites is

Why Write for Us on Techies Times – Payroll Write for Us?

Search Related Terms to Payroll Write for Us

Search Related Terms to Payroll Write for Us

- payroll

- toast payroll

- ADP payroll

- adp run payroll

- heartland payroll

- payroll calculator

- QuickBooks payroll

- gusto payroll

- payroll portal

- intuit payroll

- adp run payroll login

- ADP payroll login

- run payroll adp login

- NYC doe a payroll portal

- doe payroll portal

- payroll services

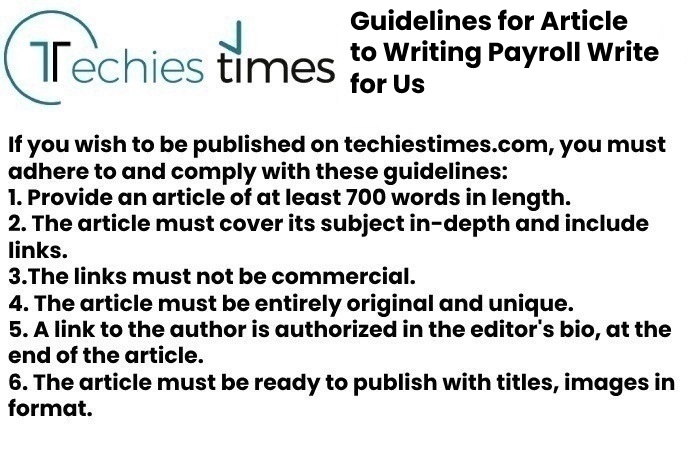

Guidelines for Article to Writing Payroll Write for Us

You can send your email to contact@techiestimes.com

Search Terms Related for Payroll Write for us

- payroll blog post ideas

- payroll guest post ideas

- payroll topics to write about

- payroll writing prompts

- payroll blog post topics

- payroll guest post topics

- payroll writing ideas

- payroll content ideas

- payroll blog post inspiration

Here are some specific examples of topics that you could write about for a payroll blog or guest post:

- How to set up a payroll system

- The different types of payroll deductions

- How to calculate overtime pay

- How to file payroll taxes

- The latest trends in payroll processing

- How to avoid payroll errors

Related Pages

The Auditor Writes for Us

Employee Engagement Write for us