Financial Literacy Write for us

This monograph focuses on various features of Financial Literacy and its importance for all generations, especially the younger group. Literacy, financial, or any other is the forever evolving ability of individuals to use socially approved signs for receiving, understanding, creating, and using texts to live within the family, school, workplace, and society.

Reading, writing, and calculating, i.e., skills without which effective operative in modern developed societies is almost unbelievable, are considered basic literacy skills. Financial Literacy is, therefore, necessary knowledge and skill and a precondition for successful and original personal growth and responsible work in an expert and social life. Internet.

How Financially Literate are People?

Finance is a part of everyday life for many 15-year-olds: they are already consumers of financial services such as bank accounts with access to online payment facilities and pre-paid mobile phones. Yet only one in ten students can tackle the most complex financial literacy tasks, such as analyzing financial products or calculating the balance in a bank statement while accounting for transfer fees. About 15% of students score below the baseline level of performance and, at best, can make simple decisions about everyday spending.

Shanghai-China has the highest scores in Financial Literacy, followed by Flanders, Estonia, Australia, New Zealand, the Czech Republic, and Poland. There are vast differences in average performance between the highest- and lowest-performing countries and economies. However, only a small proportion (16%) of the variation among countries’ mean financial literacy scores explain by per capita GDP. Among OECD countries, a more socio-economically advantaged student scores 41 points higher in financial Literacy than a less-advantaged student.

The Importance of Financial Literacy in the Development of the Education System and the Society

The ability to understand how money works must be understood by all students, regardless of their choice of course. The need to research and understand the concept of money functioning has become necessary as the volatility has increased. We teach students to become more competent. The curriculum over the years has changed according to the demand and needs of the job market and society. In the institution, we aim to have well-educated and informed citizens so they can become an asset.

Similarly, if the student is financially educated, he can plan his money better, especially his retirement. With the financial knowledge, he can secure his future and become an asset to his family and help in the country’s development. Students studying finance-related subjects often fail to make sound financial decisions. The world is becoming a global village. Any crises in any country affect us directly or indirectly; hence money management becomes necessary and needs to be taught at ground levels.

Many studies show high widespread financial illiteracy among Indians. As an educational institution, we must introduce various methods and measures at the university/ college levels to increase and enhance money-related knowledge and make our youth financially literate. This paper aims to provide a brief view of the current status of financial Literacy in India and compare it with other countries with the help of various survey results. In this paper, some suggestions are put forward to make our financial education programs more effective.

Primary Financial Objectives of Firms

financial Literacy, on average, exacerbates by patterns of vulnerability among specific population subgroups. For instance, as reported by Lusardi and Mitchell, even though educational attainment positively correlates with financial Literacy, it is insufficient. Even well-educated people are not essentially savvy about money. Financial Literacy is also low among the young. In the USA, less than 30% of respondents can correctly answer the Big Three by age 40, even though many consequential financial decisions are made well before that age.

Similarly, in Switzerland, only 45% of those aged 35 or younger can correctly answer the Big Three questions—Footnote1 And if people may learn from making financial decisions, that learning seems limited. Many older individuals, who have already made decisions, cannot answer three basic financial literacy questions.

How to Submit Your Articles

To Write for Us, you can correspondence at To Submitting Your Articles for my sites is

Why Write for Techies Times – Financial Literacy Write for Us

Search Related Terms to Financial Literacy Write for Us

- financial Literacy

- what is financial Literacy

- financial literacy definition

- financial literacy course

- what is financial Literacy?

- books on Financial Literacy

- financial literacy courses

- financial literacy month

- financial literacy books

- personal financial Literacy

- financial Literacy for kids

- the best book for Financial Literacy

- best books for Financial Literacy

- best financial literacy books

- why is financial Literacy critical?

- ever Financial Literacy

- financial Literacy meaning

- meaning of Financial Literacy

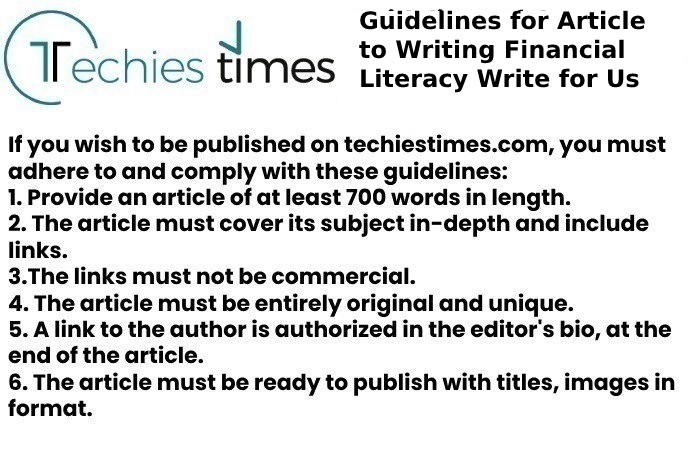

Guidelines for Article to Writing Financial Literacy Write for Us

Search Related Terms for Financial Literacy Write for Us

- Personal finance

- Budgeting

- Saving

- Investing

- Debt management

- Credit

- Retirement planning

- Insurance

- Consumer protection