Asset management Write for us.

Asset management is growing total wealth over time by obtaining, maintaining, and exchanging investments that can grow in value. They may also be called collection managers or financial advisors—they may work independently, while others work for an investment bank or financial institution.

The asset manager’s role is to regulate what reserves to make or avoid and to realize the client’s financial goals within the client’s risk tolerance limits. The resources may include stocks, bonds, real estate, supplies, other investments, and mutual funds, among the better-known choices.

Understanding Asset Management

Asset management has a double-barreled goal: snowballing value while modifying risk. The client’s acceptance of change is the first question to pose. A retiree living on the income from a collection or a pension fund overseer supervision leaving funds is risk-averse. A young person, or any daring person, might want to dabble in high-risk savings.

What is Asset Management?

Asset management invests clients’ money in the right assets to ensure optimum returns. Asset management companies (AMCs) make investment decisions on behalf of their clients. These companies usually serve huge organizations like insurance companies, pension funds, sovereign wealth funds, and High-Net-Worth Individuals.

An investment mandate drives asset management. The license contains instructions to manage a particular pool of assets in a specific way. Asset managers follow these predetermined risk parameters and investment strategies. For these services, asset management companies charge a significant amount in fees.

Types of Asset Managers

Several types of asset managers distinguish by the kind of asset and level of service they provide. Each type of asset manager has a different level of charge to the client, so it is vital to appreciate a manager’s responsibilities before deciding to invest.

Registered Investment Advisers

A registered outlay adviser is a firm that advises clients on securities trades or even achieves their portfolios. RIAs are closely regulated and must register with the SEC if they work over $100 million in assets.

Asset Broker

A broker is a different firm that acts as a midway for their clients, buying stocks and refuges and providing custody over client assets. Brokers typically do not have a fiduciary duty to their clients, so thoroughly researching before buying is always essential.

Financial Advisor

An economic advisor is an expert who can mention investments to clients or buy and sell havens on their behalf. Economic consultants may or may not have a fiduciary duty to their regulars, so it is always important to ask first. Many financial counselors specify a specific area, such as tax law or estate planning.

Asset Management is Importance

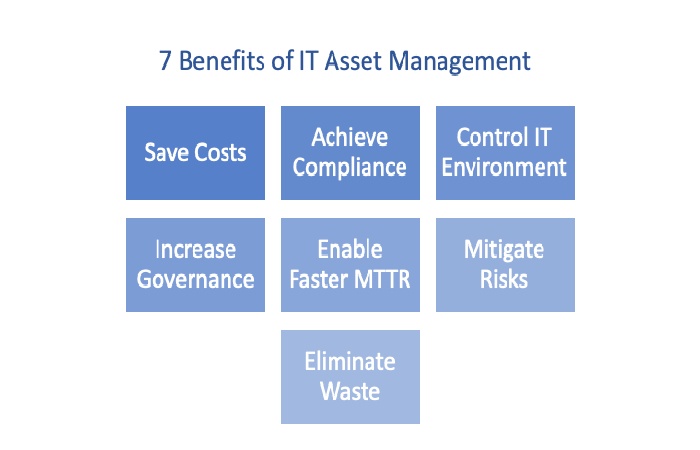

The benefits of hiring AMCs are as follows.

Selection of Appropriate Investment Vehicles: The primary role of an AMC is determining ideal investments. AMCs also decide which assets should avoid.

Risk Diagnosis and Moderation: Asset managers check the level of risk involved in an asset portfolio and take measures to reduce it.

Overall Asset Evaluation: AMC reviews all tangible and intangible assets from time to time. This way, they are updated on what their usable assets are.

Eliminating Dead Assets: Asset managers are always aware of when assets exhaust. Exhausted assets only hold a place in the accounting books and have no usability in the market. But these entries keep the financial records realistic.

Add Value to Client’s Portfolio: Asset managers incorporate valuable investments to facilitate clients’ objectives.

A Career in Asset Management

Asset Management Company care includes financial analysts, financial advisors, investment brokers, portfolio managers, and asset managers. Most AMCs are mutual fund companies or investment banks. To begin with, aspirants need a finance or economics degree. Candidates can acquire advanced finance certifications and degree courses like chartered financial analyst (CFA), MBA Finance, and FINRA series six exams. Subsequently, with added experience, analysts can scale up to become advisors and managers.

The only way to succeed in this career is by building effective relationships and growing clientele. Glassdoor reports an average of $95002 offered to asset managers in the US. The base pay starts at $56000 and goes as high as $200000. Asset management is a promising career option.

Frequently Asked Questions (FAQs)

What are asset management companies?

Asset Management Companies create asset portfolios. They streamline clients’ financial resources into the suitable investment options. The purpose of an AMC is to yield maximum returns and mitigate risk.

What are the different asset classes?

The asset classes include equities, commodities, bonds, futures, derivatives, real estate, cash, cash equivalents, marketable securities, and mutual funds.

Is asset management a promising career?

Asset Management is a rewarding career option. There is a wide range of opportunities for aspirants in large financial corporations like JP Morgan, Wells Fargo, Morgan Stanley, Soltage, and Deutsche Bank. Growth opportunities are even better than in the banking sector. Aspiring candidates require analytical skills, market knowledge, decision-making ability, problem-solving, and communication skill.

How to Submit Your Articles

To Write for Us, you can correspondence at To Submitting Your Articles for my sites is

Why Write for Techies Times – Asset Management Write for Us

Search Related Terms to Asset Management Write for Us

- asset management

- UBS asset management

- asset management system

- enterprise asset management

- asset management ratio

- asset management ratios

- Aberdeen asset management

- media asset management

- northern trust asset management

- Luxor asset management

- global asset management

- best asset management software

- asset management policy

Guidelines for Article to Writing Asset Management Write for Us

If you need any help with us, please send your email to

Search Terms Related for Asset Management Write for Us

- asset management best practices

- asset management trends

- asset management case studies

- asset management in the age of technology

- the future of asset management

- how to choose an asset manager

- what to look for in an asset management report

- asset management for beginners

- asset management for small businesses

- asset management for non-profits

Related Pages

The Auditor Write for Us – Guest Post Contribute and Submit Post.

Firmware Development Write for Us – Contribute and Submit Post.