Artificial intelligence is rapidly reshaping industries worldwide, and insurance is no exception. Allianz, one of the largest global insurance companies, has been actively integrating AI technologies to improve customer experience, automate operations, enhance risk assessment, and drive digital transformation.

Understanding how Allianz uses artificial intelligence gives valuable insight into how enterprise AI adoption works in real-world business environments.

Table of Contents

Why Insurance Companies Are Adopting AI

Insurance companies deal with:

- Massive data volumes

- Risk prediction challenges

- Customer service demands

- Fraud detection needs

Artificial intelligence helps address these challenges through:

- Machine learning analytics

- Automation systems

- Natural language processing

- Predictive modeling

This reduces costs while improving accuracy.

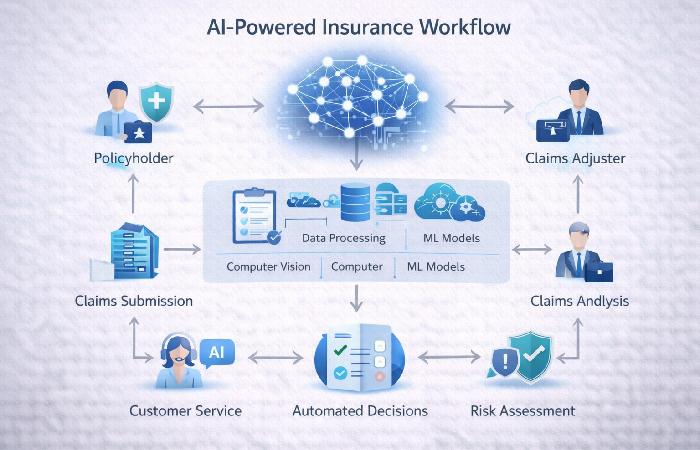

Key AI Applications at Allianz

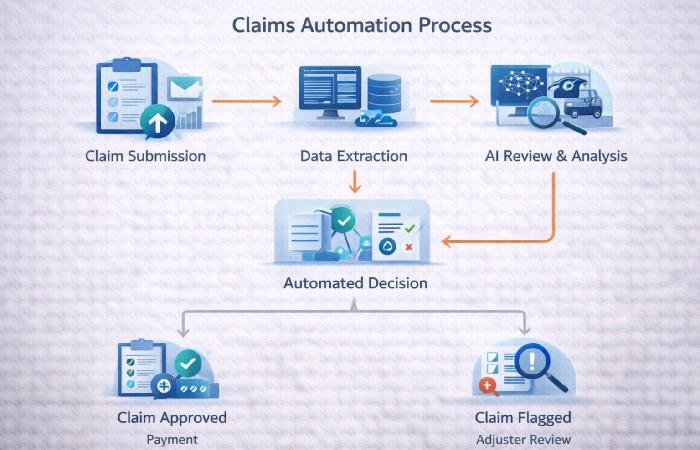

1. Claims Automation

AI helps automate claims processing by:

- Analyzing claim data

- Detecting fraud patterns

- Speeding approvals

This improves customer satisfaction because claims get resolved faster.

Automation also reduces operational expenses.

2. Risk Assessment and Underwriting

Traditionally, underwriting involved manual data analysis.

AI now enables:

- Predictive risk modeling

- Real-time data evaluation

- Behavioral risk analysis

This improves pricing accuracy.

Better risk analysis means fewer losses.

3. Customer Support AI

AI chatbots and virtual assistants help Allianz:

- Provide 24/7 customer support

- Answer policy questions

- Assist claim filing

This improves accessibility and customer experience.

4. Fraud Detection Systems

Insurance fraud costs billions globally.

AI helps by:

- Detecting suspicious patterns

- Identifying anomalies

- Preventing fraudulent claims

Machine learning continuously improves detection accuracy.

Business Impact of Allianz AI Strategy

Artificial intelligence delivers measurable benefits:

Efficiency Gains

Automation reduces manual workloads.

Employees focus on higher-value tasks.

Improved Customer Experience

Faster responses increase customer satisfaction.

Digital self-service platforms improve accessibility.

Better Decision Making

AI analytics provide:

- Market insights

- Risk trends

- Customer behavior analysis

This supports strategic planning.

AI Technologies Used in Insurance

Here are the most common AI technologies:

| Technology | Purpose |

| Machine Learning | Risk prediction |

| NLP | Customer interaction |

| Computer Vision | Claims verification |

| Predictive Analytics | Market forecasting |

| Robotic Process Automation | Workflow automation |

These technologies are becoming standard in modern insurance.

Digital Transformation in the Insurance Industry

Allianz reflects a broader industry trend.

Insurance companies globally are investing in:

- AI automation

- Data analytics

- Cloud infrastructure

- Cybersecurity

Digital transformation improves:

- Speed

- Accuracy

- Customer trust

Challenges of AI Adoption

Despite benefits, companies face challenges:

Data Privacy Concerns

Handling sensitive customer data requires strong security.

Integration Complexity

Legacy systems complicate AI deployment.

Ethical Considerations

Bias in AI models must be managed carefully.

Responsible AI practices are essential.

Future of AI in Allianz and Insurance

Future developments likely include:

Personalized Insurance Policies

AI can tailor policies to individual behavior.

Predictive Risk Prevention

Insurance may shift from reactive to preventive.

Autonomous Claims Processing

Fully automated claim settlements could become common.

Advanced Analytics Platforms

Real-time insights will improve business agility.

Business Lessons from Allianz AI Strategy

Companies can learn several things:

Invest Early in Technology

Early adopters gain competitive advantage.

Focus on Customer Experience

Technology should improve usability.

Combine AI With Human Expertise

AI enhances — not replaces — human decision-making.

Continuous Innovation Matters

Digital transformation is ongoing.

Practical Takeaways for Businesses

If you run a business or tech startup:

- Adopt data-driven decision making

- Automate repetitive tasks

- Use AI analytics for insights

- Invest in digital infrastructure

These steps improve competitiveness.

Frequently Asked Questions

Is Allianz heavily investing in AI?

Yes. AI supports claims automation, analytics, customer service, and fraud detection.

Does AI replace insurance employees?

No. It mainly improves efficiency while humans handle complex decisions.

How does AI benefit customers?

Faster claims, personalized policies, and better support.

Is AI safe in insurance?

Yes, when combined with strong security and ethical standards.

Conclusion

Artificial intelligence is transforming the insurance industry, and Allianz stands as a strong example of enterprise AI adoption. From automated claims processing to predictive analytics and customer support systems, AI is helping insurers improve efficiency, accuracy, and customer experience.

As AI technology continues evolving, companies like Allianz will likely lead innovation in insurance, setting standards for digital transformation across industries.

For businesses, the lesson is clear: embracing AI strategically can unlock growth, efficiency, and competitive advantage.