If you’ve ever launched a product, planned a campaign, or tried to understand what customers actually want, you’ve probably heard of a market survey.

Simply put, a market survey is one of the most practical tools businesses use to reduce guesswork. Instead of assuming what people want, you ask them directly — and use their responses to guide decisions.

In this guide, we’ll cover:

-

What a market survey really is

-

The main objectives of a market survey

-

Types of market surveys

-

Benefits and limitations

-

Common mistakes people make

-

Practical tips and real examples

All explained in clear, human language.

Table of Contents

What Is a Market Survey? (Simple Definition)

A market survey is a research method used to collect information directly from a target audience about their needs, preferences, behavior, and opinions.

Businesses use market surveys to answer questions like:

-

What problems do customers face?

-

How satisfied are they with current products?

-

What features or improvements do they want?

-

How much are they willing to pay?

Instead of relying on assumptions, surveys provide real feedback from real people.

Why Market Surveys Matter Today

Markets are more competitive than ever. Customer expectations change quickly, and a single misstep can cost time and money.

Market surveys help by:

-

Reducing business risk

-

Improving product-market fit

-

Supporting smarter marketing strategies

-

Helping companies stay customer-focused

Whether you’re a startup, a large company, or even a student working on a project, market surveys give direction.

Objectives of a Market Survey

The main objectives of a market survey are to understand the market and make informed decisions.

1. Understand Customer Needs and Preferences

One of the primary goals of a market survey is to learn what customers actually want.

This includes:

-

Their problems and pain points

-

Preferred features or services

-

Buying habits and expectations

When businesses understand their customers clearly, they can design better solutions rather than guess.

2. Measure Customer Satisfaction

Market surveys help assess how happy customers are with:

-

Products or services

-

Pricing

-

Customer support

-

Overall experience

Customer satisfaction surveys often reveal issues that aren’t visible through sales data alone.

3. Identify Market Demand and Trends

Surveys can uncover:

-

Emerging trends

-

Shifts in consumer behavior

-

Changes in demand

This information helps businesses stay ahead of competitors rather than reacting too late.

4. Support Product Development and Improvement

Before launching a new product — or improving an existing one — companies use surveys to test ideas.

For example:

-

Feature preference surveys

-

Prototype feedback surveys

-

Pricing sensitivity surveys

This minimizes the risk of launching something customers don’t want.

5. Improve Marketing and Communication

Market surveys help marketers understand:

-

Which messages resonate

-

Which channels do customers prefer

-

What influences purchasing decisions

As a result, campaigns become more targeted and effective.

Types of Market Surveys

Different goals require different survey approaches.

1. Customer Satisfaction Surveys

These surveys measure customer satisfaction after a purchase or interaction.

They usually include:

-

Rating scales

-

Short feedback questions

-

Net Promoter Score (NPS)

2. Product Feedback Surveys

Used to gather opinions on:

-

New features

-

Product usability

-

Design and functionality

These surveys are common during beta testing or product updates.

3. Brand Awareness Surveys

These surveys help businesses understand:

-

How well their brand is recognized

-

Brand perception

-

Trust and credibility

They’re especially useful for marketing and branding strategies.

4. Market Segmentation Surveys

Segmentation surveys group customers based on:

-

Age, location, income

-

Interests and behavior

-

Buying patterns

This helps businesses target the right audience more effectively.

5. Competitive Analysis Surveys

These surveys compare your product or service with competitors by asking customers directly what they prefer — and why.

Benefits of Conducting a Market Survey

Market surveys offer several clear advantages:

✔ Better decision-making

✔ Reduced business risk

✔ Stronger customer relationships

✔ Improved product and service quality

✔ More effective marketing strategies

In short, surveys help businesses move from assumptions to insights.

Limitations of Market Surveys

While market surveys are powerful, they’re not perfect.

Some limitations include:

-

Biased responses

-

Low response rates

-

Poorly designed questions

-

Misinterpretation of data

This is why survey design and analysis matter as much as data collection.

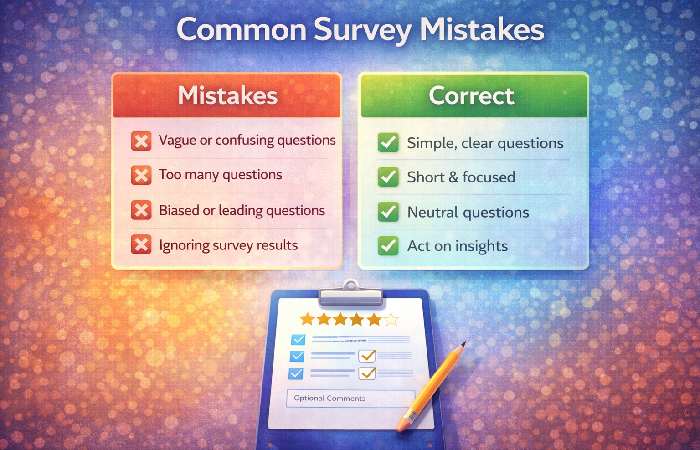

Common Mistakes People Make in Market Surveys

Many surveys fail not because surveys don’t work, but because they’re done incorrectly.

❌ Asking vague or confusing questions

Respondents don’t know how to answer clearly.

❌ Asking too many questions

Long surveys lead to drop-offs and poor-quality responses.

❌ Using biased or leading questions

This skews results and reduces reliability.

❌ Ignoring the results

Collecting data without acting on it defeats the purpose.

Practical Tips for Running an Effective Market Survey

Here are some proven tips to improve survey results:

✔ Keep surveys short and focused

✔ Use simple, clear language

✔ Avoid leading questions

✔ Test the survey before sending it

✔ Analyze results objectively

✔ Share insights with decision-makers

From experience, a short, well-designed survey often performs better than a long, complex one.

Real-World Examples of Market Surveys

Example 1: Product Improvement

A mobile app surveys users about feature usage and removes rarely used features to improve performance.

Example 2: Pricing Strategy

A company tests different price points through surveys before finalizing product pricing.

Example 3: Customer Experience

An e-commerce brand surveys customers after delivery to identify issues in packaging or shipping.

Myths vs. Facts About Market Surveys

| Myth | Fact |

|---|---|

| Surveys always reflect the full market | They reflect the surveyed audience |

| More questions mean better insights | Focused questions work better |

| Surveys are expensive | Many tools offer low-cost or free options |

| Surveys guarantee success | They guide decisions, not guarantee outcomes |

When Should You Conduct a Market Survey?

Market surveys are useful when:

-

Launching a new product

-

Entering a new market

-

Improving existing offerings

-

Measuring customer satisfaction

-

Planning marketing campaigns

They’re not a one-time activity — successful businesses survey continuously.

Image Suggestions (3)

1. Featured Image

-

Placement: Top of article

-

Idea: People answering a survey on mobile and laptop with charts in the background

-

Filename: market-survey-overview.jpg

-

ALT text: “Market survey showing customer feedback and data analysis.”

2. Types of Market Surveys

-

Placement: “Types of Market Surveys” section

-

Idea: Infographic showing different survey types

-

Filename: types-of-market-surveys.jpg

-

ALT text: “Different types of market surveys explained visually.”

3. Survey Mistakes Illustration

-

Placement: “Common Mistakes” section

-

Idea: Checklist with mistakes and correct approaches

-

Filename: market-survey-mistakes.jpg

-

ALT text: “Common mistakes to avoid when conducting a market survey.”

FAQs (Snippet-Ready)

Q: What is the main objective of a market survey?

A: The main objective is to understand customer needs and market conditions to support better business decisions.

Q: Are market surveys only for large businesses?

A: No, startups, small businesses, and students can all benefit from market surveys.

Q: How long should a market survey be?

A: Ideally short — usually 5–10 minutes — to maintain response quality.

Q: Can online surveys replace face-to-face surveys?

A: Online surveys are efficient, but both methods have value depending on goals.

Final Conclusion

A market survey is one of the most effective ways to understand customers, reduce uncertainty, and make informed decisions. By clearly defining objectives, choosing the right survey type, and avoiding common mistakes, businesses can turn customer feedback into meaningful action. When done correctly, market surveys don’t just collect data — they guide smarter strategies and long-term success.