Tax accounting is a set of methods for accounting focused on preparing public financial statements that show tax assets and liabilities. This tool considers revenue, deductions, and government credits to determine the taxable income of a business. The Internal Revenue Code outlines the rules and regulations for tax accounting. This code describes the rules companies and individuals must follow when preparing any tax document.

The accounting practices professionals use to determine a company’s tax liability can differ from the company’s accounting practices for determining its assets and liabilities on a balance sheet.

What is Tax Accounting?

Accounting information is more concerned with calculating and reporting taxes than with displaying public financial statements.

When submitting tax returns, individuals and corporations must adhere to specific procedures outlined in the Revenue Code. This code also serves to control tax accounting standards.

Keeping financial records for the government’s use is known as tax accounting. People on an individual level and organizations, corporations, and other institutions could be impacted. Even though they may not be obligated to pay taxes, those individuals are still required to participate in the accounting process. Tax accounting designs make it possible to keep tabs on the money associated with enterprises and individuals.

Why is Tax Accounting Important?

Tax accounting is essential because it helps companies follow financial regulations to avoid penalties. Proper tax accounting can also ensure companies benefit from tax programs that can save them money on their taxes. The purpose of tax accounting is to allow the government to track a company’s finances to ensure the company follows financial laws.

Types of Tax Accounting

Tax Accounting for Individuals

For an individual taxpayer, tax accounting focuses solely on income, qualifying judgments, investment gains or losses, and other dealings that affect the individual’s tax burden. This limits the information necessary for an individual to manage an annual tax return. While an individual can use a tax accountant, it is not a legal must.

Meanwhile, general accounting would involve tracking all funds coming in and out of the person’s control regardless of the purpose, including personal costs, with no tax implications.

Tax Accounting for Businesses

From a business perspective, more information must analyze in the tax accounting course. While the company’s earnings, or incoming funds, must be followed just as they are for the individual, there is an additional complexity regarding any outgoing funds directed toward certain business obligations. This can include funds directed toward specific business expenses and funds directed toward shareholders.

While it is also not required that a business use a tax accountant to perform these duties, it is relatively common in larger organizations due to the difficulty of the records involved.

FAQs Questions

What Is the Main Purpose of Tax Accounting?

Companies use tax accounting to help them make the proper tax calculations and prepare tax documents in time for filing season.

What Is the Difference Between a Tax Accountant and a Management Accountant?

A management accountant is an internal party who cannot work with external clients, while a tax accountant is an external party who can work with other businesses and individuals. Management accountants assist their companies with the financial implications of business decisions or provide strategic advice. Tax accountants help companies and individuals comply with taxation requirements.

How Can You Start a Career in Tax Accounting?

Tax accountants need a CPA licensure. This usually requires a bachelor’s degree in an accounting-related field. Also, although it does not need by every company hiring tax accountants, CPA candidates should complete a master’s program in accounting.

Once the CPA licensure obtains, tax accountants often require continuing education (CE) courses to maintain their credentials. The CE requirements and length vary by state.

How to Submit Your Articles

To Write to Us, you can correspondence at To Submitting Your Articles for my sites is

Why Write for Techies Times – Tax Accounting Write for Us

What We Look for

What We Look for

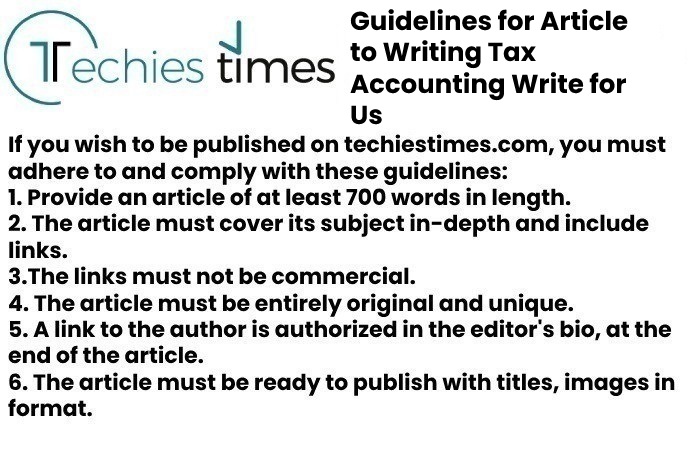

Successful guest post contributions should be comprehensive, data-driven, engaging, and educational. To increase your chances of getting available on our blog, ensure that your donation,

- It is a relevant, well-researched post (preferably 1000+ words) with actionable tips.

- It is 100% original and unpublished. We will not republish anything that is published elsewhere.

- Only includes claims backed by links to credible research or case studies. Avoid citing our competitors and using any irrelevant promotional links to websites.

- Includes examples and relevant images to illustrate your point. Avoid using stock photos that don’t add any value to the copy. Use Create to visualize data, information, courses, ideas, and frameworks.

- Includes subheadings, bullet points, and shorter sections, making the article more explicit.

Topics We Cover

Most of our audience involves individuals and teams from different structural departments looking for tips, best practices, and guides on working and cooperating visually. As we aim to build an honest library of data and visions that they can refer to improve and update their workflows, we only accept explicit, compelling content falling into the following categories,

- Visual collaboration

- Visual project management

- Business and technical diagramming

- Visual problem-solving

- Visual creativity and message

- Data imagining

- Design thoughtful

Business procedure modeling

Please raise to the existing posts on our blog to appreciate and identify more topics, content layouts, language, and tones that we prefer.

Search Related Terms to Tax Accounting Write for Us

- tax accounting services

- tax accounting software

- what is tax accounting

- sales tax accounting

- tax accounting near me

- tax accounting firms

- tax accounting jobs near me

- freedom tax accounting

- Austin tax accounting

- small business tax accounting

- tax accounting firm

- federal tax accounting

Guidelines for Article to Writing Tax Accounting Write for Us

You can send your email to contact@techiestimes.com

Search Terms Related for Tax Accounting Write for Us

- tax accounting blog post ideas

- tax accounting guest post ideas

- tax accounting topics to write about

- tax accounting writing prompts

- tax accounting blog post topics

- tax accounting guest post topics

- tax accounting writing ideas

- tax accounting content ideas

- tax accounting blog post inspiration

Here are some specific examples of topics that you could write about for a tax accounting blog or guest post:

- The latest tax changes and how they affect businesses and individuals

- Tips for filing your taxes on time and accurately

- How to save money on your taxes

- The different types of taxes and how they work

- The importance of having a good tax accountant

- The latest trends in tax accounting

- How to start your own tax accounting business

Related Pages

Construction Project Write for us